Consumer spending is the backbone of the U.S. economy, constituting over two-thirds of our nearly $28 trillion GDP. When consumers spend money on everyday goods and services, and make large one-time purchases, it not only helps to spur economic growth but is also a reflection of economic trends. This is because many factors affect consumer purchases including consumer sentiment, the job market, household net worth, inflation, housing prices, the stock market and more. What do investors need to know about the state of the consumer and how it might affect the economy and stock market in the coming year?

Consumer spending is the largest component of U.S. GDP.

Of the various components of GDP, consumer spending has been the most stable over the past decade at a time when government spending has fluctuated, business investment has been low, and the country has been a net importer of goods. In the fourth quarter of 2023, the economy grew 3.3% with consumer spending contributing 1.9 percentage points to that total. The strength of the consumer has helped the economy stay out of recession despite high inflation rates, layoffs in the tech sector, and ongoing uncertainty. In turn, this has helped to propel the stock market to new all-time highs.

While consumer spending has a direct impact on economic growth, how everyday consumers feel about the economy can vary dramatically over time. Perhaps the best example is the decade following the 2008 global financial crisis. Consumer sentiment was poor for many years due to a weak job market. The housing bust and a sharp decline in manufacturing activity led many to give up on finding work, resulting in a falling labor force participation rate. Even when the overall economy was recovering, consumers were pessimistic. The fact that housing prices collapsed and it took the S&P 500 five years to recover also led to lower consumer net worth.

In many ways, the situation today is the opposite of the post-2008 period. Despite fears of economic weakness, the unemployment rate is still at a historically low 3.7%, 353,000 jobs were added in January, wages have risen over 4% during the past year, and there are still nine million job openings across the country. The fact that the stock market is near all-time highs has also helped to boost the “wealth effect” among consumers. While the housing market still faces many challenges with 30-year mortgage rates around 7%, transactions that do occur are closing at relatively high prices.

Consumers are feeling more optimistic about the economy.

The accompanying chart shows that while consumer sentiment has not yet returned to historical averages after plummeting two years ago, they have improved dramatically. The rise and fall of inflation has been a major contributor to this effect since rising prices directly hit consumer pocketbooks. Inflation rates based on measures such as the Consumer Price Index have improved and the same University of Michigan survey shows that consumers expect inflation over the next year of only 3%. Gasoline prices, for instance, are hovering around $3.20 on average after reaching $5 less than two years ago.

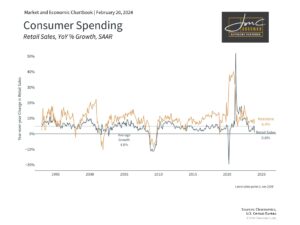

While the consumer story is mostly positive, there are reasons to believe that spending could slow. Households have drawn down their extra cash and savings rates have fallen to only 3.7%, well below the historical average of 6.3%. Recent consumer spending data have also been mixed. On a year-over-year basis, retail sales have decelerated to 0.6%, or -0.8% month-over-month. As the accompanying chart shows, even online retailers have experienced a slowdown in growth after a decade of robust sales growth.

Retail sales have decelerated as consumers have drawn down their savings.

Another important piece of the consumer puzzle is the level of household debt. Higher interest rates are a drag on household income statements and balance sheets, especially with the 10-year Treasury yield back around 4.3%. The latest Federal Reserve Bank of New York data show that total credit card debt is just under $1.13 trillion and 9.7% of balances are 90 days delinquent or more. Student loans are also back in the news with the White House seeking to forgive certain eligible borrowers. While there are no easy solutions to these underlying challenges, the financial stress on consumers could improve somewhat as the Fed begins to cut rates later this year.

The bottom line? Consumers are increasingly optimistic as inflation improves and the job market remains strong. While there are still challenges ahead, consumer spending could continue to support the economy and stock market.

To schedule a 30 minute call, click here.